For South Africans, driving comes with a unique set of challenges. This includes everything from navigating intersections during load shedding to trying to protect your car against pothole damage. But while incidents on the road can and do happen unexpectedly, there are a few steps you can take to avoid having to make the most common car insurance claims.

Common car insurance claims

Most accidents on the road happen during traffic and at intersections. Additionally, car theft and damage caused by bad weather are other common reasons for claims. Knowing what these typical scenarios are and how to avoid them is essential for driving more confidently.

In this article, we’ll give tips to increase your safety on the road, reducing your chances of needing to claim.

Crash at intersection

Intersections can be risky if drivers aren’t careful, especially when traffic lights are out due to load shedding. Careless drivers, pedestrians, and cyclists often violate traffic rules when approaching an intersection.

That’s why it’s crucial to double-check for cars entering the intersection before driving off, even if you have the right of way.

Rear-end accident

Rear-end accidents are one of the most common traffic incidents. To avoid becoming a statistic, maintain a safe following distance of at least three seconds from the car in front of you. Avoid distractions like texting or eating while driving to help you stay focused.

By following the rules of the road and practising defensive driving, you can significantly reduce the risk of rear-end crashes.

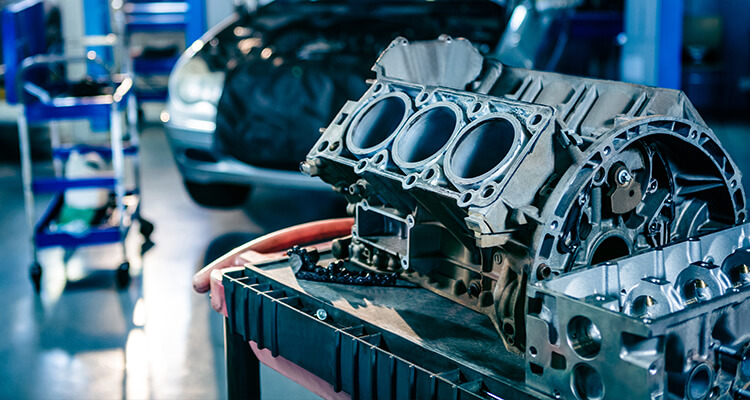

Unroadworthy vehicle

Driving your car when it’s not roadworthy puts you at greater risk and may lead to your claim being denied by your insurance provider.

Regularly inspect your vehicle to ensure all lights, brakes, tyres, and other critical parts are in good working order. Regular maintenance and servicing are key to safe driving.

Car theft

Car theft is an unfortunate reality in South Africa, but there are ways you can help prevent it from happening to your car. At night, always park your vehicle in well-lit areas or secure parking lots and avoid leaving it in a remote place.

Remember to check that your car is locked and activate security features like immobilisers or alarms. Also, consider installing a tracking device so your car can be easily located if stolen.

Always make sure that you check your car insurance policy that it includes cover in the event of theft and hijacking to prevent any costly disappointments.

Pothole damage

To limit the damage caused by potholes, it’s important to be alert and on the lookout for them, especially on poorly maintained roads or after heavy rainfall. Slow down, keep a distance from other cars, and avoid making sudden manoeuvres.

Be especially cautious of hidden potholes filled with water after rain. On top of this, keep your tyres properly inflated with sufficient tread depth.

Accident due to bad weather

Unfortunately, weather conditions often result in car accidents, especially in winter. To reduce your risk, adjust your driving by slowing down, keeping a safe distance, using headlights in poor visibility, and making sure your wipers are in good working condition. Also, check the weather reports ahead of time so you can avoid flooded areas, as rising water can damage your car.

Most importantly, ensure your car insurance policy includes benefits like hail damage cover.

Windshield damage

To prevent claiming for windshield damage, keep a safe distance from trucks and construction vehicles that may throw debris. Also, avoid driving behind large trucks, as they often kick up stones.

If you notice a crack or chip, repair it quickly to prevent it from getting worse or posing a safety risk. Finally, ensure you’re covered for glass replacement in your car insurance policy. With Prime South Africa’s Comprehensive Car Insurance Cover, this is included.

Make sure you’re (fully) covered

Car insurance policies and providers differ when it comes to what’s included and not, so make sure you understand what you’re covered for.

At Prime, we strive to make our policies as easy to understand as possible. To ensure you have the help you need in case of emergencies, we also offer 24-hour roadside assistance and towing on some of our plans.

Enjoy safer driving

By following these simple tips, you can greatly reduce your chance of having to claim from car insurance. Stay alert, drive responsibly, and enjoy the peace of mind that comes with knowing you’ve taken steps to keep you safe on our roads. And remember to share these insights with your friends and family to promote a culture of safe driving in South Africa.

Affordable car insurance with a car insurance provider that makes claiming easy is essential for every driver’s peace of mind. Explore our various car insurance options or get a quick online quote today.

Disclaimer

This article provides general information on common car insurance claims in South Africa and how you can avoid them. However, there are many reasons people claim from car insurance not listed here. Additionally, by following these tips, we cannot guarantee you won’t get into an accident and need to claim.

Remember to always buy car insurance with much thought and only through a certified financial services provider.

Contact us today to learn more about affordable, comprehensive car insurance with fixed premiums* and a reduce-to-zero excess*. *T&Cs apply.