Prime Comprehensive Car insurance loaded with our unique extras

-

Starting

at - R409pm*

- Haval Jolion 1.5T Luxury

-

Accident and write-off cover

-

Theft and hijacking cover

-

Natural fire and disaster cover

-

Hail damage and glass cover

-

R1 million third-party protection

Your included benefits, unique to Prime

Included unique benefits

24-Month Fixed Premium Guarantee

Prime’s premiums are affordable and only increase every 24 months!*

Reducing Excess

Your basic excess reduces every month you don’t claim.*

Free Accidental Death Cover

Get R10,000 paid to your family if you die unexpectedly in a car accident.

Passenger Protect Cover

Road Accident Fund Claim Assist

Always-On Accident Detection

If you have a serious car accident, our Prime Protect app will detect the collision and notify us immediately. We’ll contact you to assist or dispatch help as required.

24/7 Emergency Roadside Assistance

In the event of an accident or breakdown, we’ll be there to help!

“It was excellent, I won't complain she gave me all the answers I wanted to hear, I am happy she was the best. ” - Sboniso Hadebe

See what else is included

Not just any comprehensive car insurance

Prime's Comprehensive car insurance includes unique benefits only available at Prime

Cover for your car

-

Accident and write-off coverYou’re covered if you have an accident, or damage or write off your car.

-

Theft and hijacking coverIf your car is stolen or hijacked, you’re covered.

-

Natural fire and disaster coverIf your car is damaged or destroyed due to a naturally occurring fire or natural disaster, you’re covered.

-

Glass coverIf your car’s glass or windscreen is accidently damaged, you’re covered.

-

Hail damage coverIf your car is damaged as a result of hail fall, you’re covered.

-

Third-party liability protectionEnjoy up to R1 million liability cover if you accidentally damage another person’s car or property.

-

24-hour roadside assistRest easy knowing you’re never alone out there on the roads with our 24-Hour Roadside Assist.

-

100% retail value coverFeel good knowing that you’re insured right up to the full retail value of your car.

Prime Protect app benefits for you

-

Free Accidental Death CoverR10,000 paid to your loved ones if you pass away in a car accident while driving your insured car. Your family can use this money for anything they need. Pay off debt. Cover final expenses. It’s your choice!

-

Passenger Protect (Private Medical Treatment)Private medical treatment for passengers injured in your vehicle! With Passenger Protect, any passengers injured whilst in your vehicle will be taken to the closest hospital to be stabilised. Once stabilised, Prime Passenger Protect will arrange their transport to a supported private medical facility for further treatment.

-

Road Accident Fund CoverGet expert advice and assistance for injured drivers when claiming compensation from the Road Accident. Feel supported every step of the way as we help you to claim up to 100% payout for medical bills, lost earnings, funeral expenses and more.

Road Accident Fund CoverGet expert advice and assistance for injured drivers when claiming compensation from the Road Accident. Feel supported every step of the way as we help you to claim up to 100% payout for medical bills, lost earnings, funeral expenses and more. -

Exclusive Savings with Lower Excess Fees*Enjoy reduced excess fees simply by keeping your Prime Protect App installed and active on your phone. This means less out-of-pocket expenses for you when you need it most.

Exclusive Savings with Lower Excess Fees*Enjoy reduced excess fees simply by keeping your Prime Protect App installed and active on your phone. This means less out-of-pocket expenses for you when you need it most. -

24/7 Always-on Accident DetectionHave peace of mind knowing that Prime will be there for you even when you may not be able to call for help after a serious car accident. Prime Protect is your companion in safe travelling!

24/7 Always-on Accident DetectionHave peace of mind knowing that Prime will be there for you even when you may not be able to call for help after a serious car accident. Prime Protect is your companion in safe travelling! -

Free 24/7 Emergency AssistWhatever the time, wherever you are, Prime is always there for you! Enjoy free 24/7 emergency roadside assistance benefits that keep you safe and get you moving again.

Free 24/7 Emergency AssistWhatever the time, wherever you are, Prime is always there for you! Enjoy free 24/7 emergency roadside assistance benefits that keep you safe and get you moving again.

Optional extras

-

Car hireCar in for damage repairs? No problem. Get up to 30 days car hire to keep you moving!

-

Credit shortfall protectionCar stolen or written-off? Insurance paid out? Still owe the bank money? We’ve got you covered.

-

Accidental death extenderInexpensively upgrade your included Accidental Death benefit up to R100,000.

-

Tyre and rim coverCovers the cost of replacing or repairing your tyres and rims if they’re damaged by road hazards.

Unique Prime benefits included with Comprehensive

24-Month Fixed Premium Guarantee

Prime’s premiums are affordable and only increase every 24 months!*

Reducing Excess

Your basic excess reduces every month you don’t claim.*

Free Accidental Death Cover

Get R10,000 paid to your family if you die unexpectedly in a car accident.

Passenger Protect

Get private medical treatment for passengers injured in your vehicle with our Prime Protect App.

Road Accident Fund Claim Assist

With our Prime Protect app, you get free expert advice and assistance for injured drivers when claiming compensation from the Road Accident Fund.

24/7 Always-On Accident Detection

If you have a serious car accident, our Prime Protect app will detect the collision and notify us immediately. We’ll contact you to assist or dispatch help as required.

24/7 Emergency Roadside Assistance

In the event of an accident or breakdown, we’ll be there to help!

Unique Prime benefits included with Comprehensive

Fixed Premiums*

Your affordable premiums will only increase every 24 months*.

Reducing Excess*

If you don’t claim, your excess will reduce every month until it’s zero*

Accidental Death Cover

Get up to R10,000 paid to your family if you die unexpectedly in a car accident.

Road Accident Fund

With our Prime Protect app, you get free expert advice and assistance for injured drivers when claiming compensation from the Road Accident Fund.

Passenger Protect

Get private medical treatment for passengers injured in your vehicle with our Prime Protect app.

Join the Prime Family

We can't wait to meet you

Looking for more car insurance options?

Browse our other Prime car insurance cover options, designed to suit every budget and lifestyle

Real peace of mind wherever you go

Real peace of mind wherever you go

Find out what others say about us…

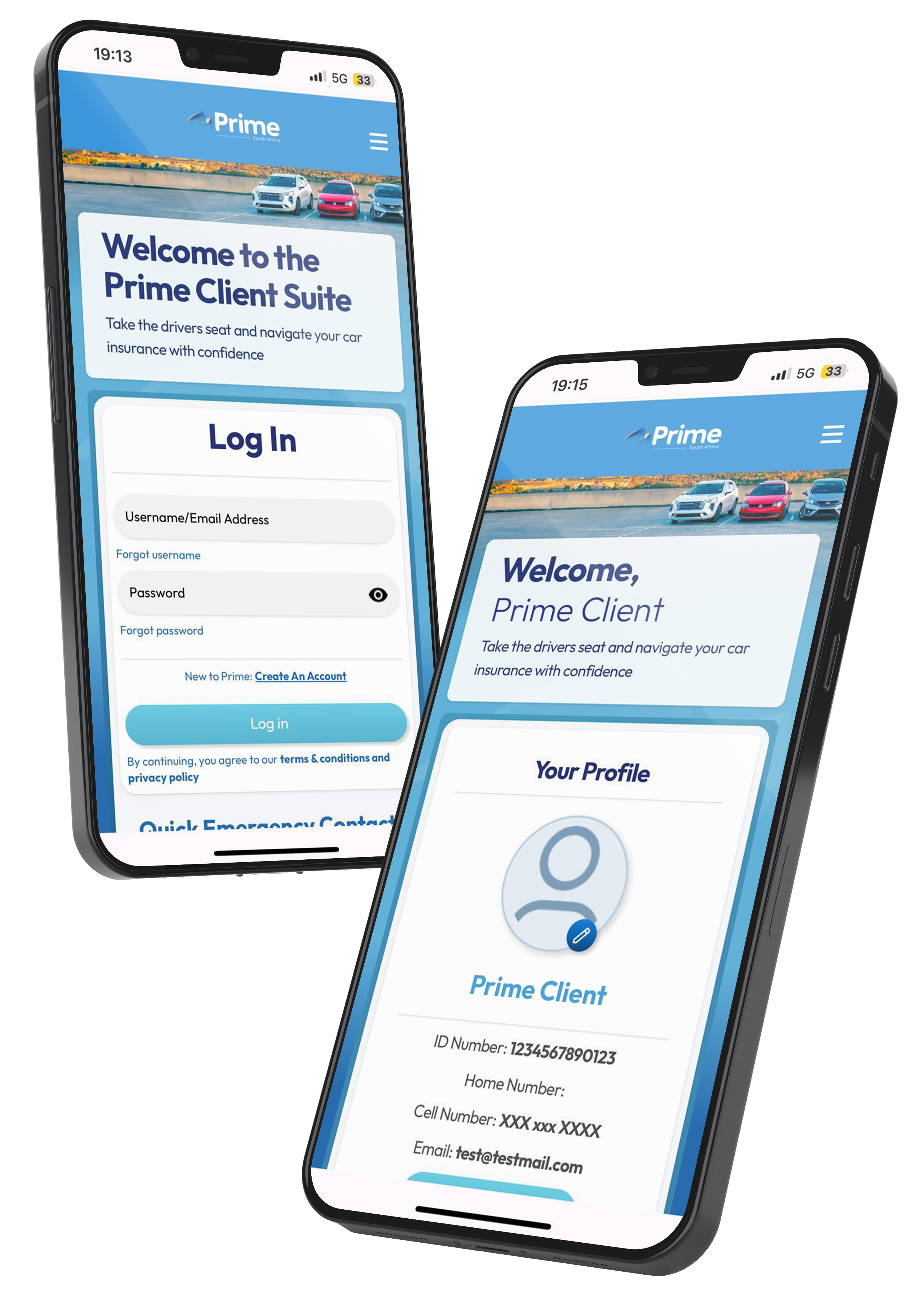

Keep Prime in your pocket

Get easy access to our services, emergency assist, claims information, policy documents, plus benefits and awards when you download the Prime app.

-

Easy step-by-step claim capture

-

You can upload your policy photos easily

-

Access to all your personal details to view or update

-

Emergency contact numbers and important information are always with you

Why Do You Need Comprehensive Car Insurance When Buying a New Car?

When financing a new car in South Africa through an automaker’s finance facility, it is compulsory for you to have comprehensive car insurance. Even though the car is registered in your name you still owe money to the finance institution that financed your car. Your car is technically only yours once you have paid it off.

What is Comprehensive Car Insurance?

Comprehensive car insurance is compulsory to have when you buy a new car that is being financed, but it is also a good option even if you have a fully paid-off car. But what does Comprehensive car insurance cover?

- Damages to your own car if you were in an accident (remain mindful of the excess payment that needs to be made).

- Full/partial damage done to another vehicle that was directly involved in an accident with you (Third Party cover).

When will you have to pay excess?

You will have to pay an excess to your insurer when you lodge an accident claim against your car’s insurance. The reason for payment of an excess amount to insurance companies is to maintain an affordable monthly premium on your policy.3

If you were not to pay an excess, which is an option, your monthly insurance premium would most likely be excessively high.

By charging excess, insurance companies incentivise customers to not claim for every small scratch, bump or chip on their car. Having to pay an excess is financially better for the customer in the long run. Make sure, when you take out your insurance policy, that you can pay the required excess. Remember, you can pay little to no excess, but then your insurance premium will be much higher every month.

Tips for Buying Comprehensive Car Insurance

- Shop around: Remember, when buying a new car, to factor into your budget the monthly car insurance premium. Work out a budget beforehand, so there are no nasty surprises. Get quotes from different insurance companies.4

- Lower premiums: Lower premiums might mean the insurance company doesn’t cover everything if you have an accident. There is a reason you are paying lower premiums. Always remember to read the fine print.4

- Excess: when looking for car insurance, find an insurer that can allow you to choose an excess that best suits your budget.4

- Decreasing premiums: when your car’s value goes down, so can your insurance premium. Make sure to review your policy at least once a year – you could pay less on your car insurance and save money in the end.4

We recommend that you drive safely and obey the rules of the road whatever you decide to do regarding car insurance.

Client review

A happy PMD client, Thulani Madatshi, took the time to write the following review:

The Potential Benefits of Comprehensive Car Insurance

Perhaps you are curious to know what the potential benefits are to having comprehensive car insurance. We will explore some of these possible benefits that South African motorists could enjoy.

Disclaimer

Signing up for comprehensive car insurance is a significant decision to make. Every motorist should seek advice from a certified financial advisor before you buy car insurance. The content of this article is only for informational purposes and not as financial advice of any kind. *Feel free to read the terms and conditions of Comprehensive car insurance with Prime.

New cars

When financing a new vehicle in South Africa through a car manufacturer’s finance facility, it is compulsory for you to have comprehensive car insurance. Your new car will be registered in your name. Nevertheless, you still owe money to the financial institution that financed your vehicle. Your vehicle only actually belongs to you once you have paid it off in full.

Comprehensive car insurance is compulsory to have when you finance your new car purchase. Comprehensive cover may also be a good option even if you have a fully paid-off car.

Comprehensive cover benefit

Enjoy car insurance cover that offers write-off and accident cover. Natural fire damage, disaster damage, theft and hijacking cover is also included.

Third-party liability cover benefit

Third-party cover is useful to have as well, especially when it could cover as much as R1 million per incident.

Full retail value cover benefit

Full retail value cover could be favourable to have should you accidentally write off your car. This benefit refers to getting paid out for what your written-off car’s retail value was at the time of the relevant accident.

Roadside assistance and towing benefit

Sometimes cars breakdown as a result of a mechanical failure or accident. Twenty-four-hour roadside assistance and a towing benefit come in handy for those types of situations.

Hail damage cover benefit

South Africa is known to have severe hailstorms. A hail damage cover benefit will give you peace of mind should you get stuck in a hailstorm in your car.

Glass cover benefit

Roads often have small debris like stones that cars can kick up and damage the windscreen. A glass cover benefit is useful if your car’s window glass is accidentally damaged.

Comprehensive car insurance could include additional optional benefits, which might be considered.

Car rental reimbursement benefit

You may need to hire a car while your car’s accident damage is being repaired. Renting a car could be expensive. So being covered for car rental costs may be useful.

Credit shortfall benefit

It is an unfortunate situation if you accidentally write-off your car, especially if you still owe money on it. A credit shortfall benefit is helpful in this situation, which covers you for that outstanding amount that you owe on the written-off car.

Accidental Death benefit

Unfortunately, tragedies do happen sometimes. An accidental death cover is beneficial should a motorist pass away as a result of an accident. The accidental death benefit is designed to pay out the policyholder’s beneficiary an amount of money that is equal to the value of your insured car.

Additional vehicle drivers benefit

Sometimes other people drive our cars for various reasons. Perhaps you should consider adding additional people who are covered by your insurance to drive your vehicle.

Research your car insurance options from insurers

Do your research before you buy comprehensive car insurance. Carefully and objectively compare different insurers’ quotes. Also, be mindful of comparing what each car insurance company’s car insurance cover includes and excludes. Enjoy many safe, happy miles in your car, whichever car insurance you choose to buy.

Disclaimer

Buying car insurance is a serious decision. Please seek advice from a certified financial advisor before you decide to purchase car insurance. This article is for informational purposes only and it does not necessarily refer to a particular car insurance product from any specific insurer. In South Africa, with the high occurrence rate of road accidents, theft and hijackings in certain areas, even if you have paid your car off, it would still be in your best interest to have comprehensive car insurance. A report from the SAPS revealed that 16,325 cars were hijacked and 50,663 vehicles were stolen between 2017 and 2018.2

According to the AA, between 65% and 70% of the 12 million cars registered in South Africa are not insured.1 This includes Third Party liability insurance. Therefore, if you were to be involved in an accident with one of these uninsured road users, you would most likely have to pay for your own car to be repaired or replaced.